35+ quicken loans asset-based mortgage

Web This combo of a virtual application process and real people along with a slew of loan products helped the company become a top mortgage lender and the biggest lender of FHA loans in the nation. From the Linked Asset Account drop-down list select none.

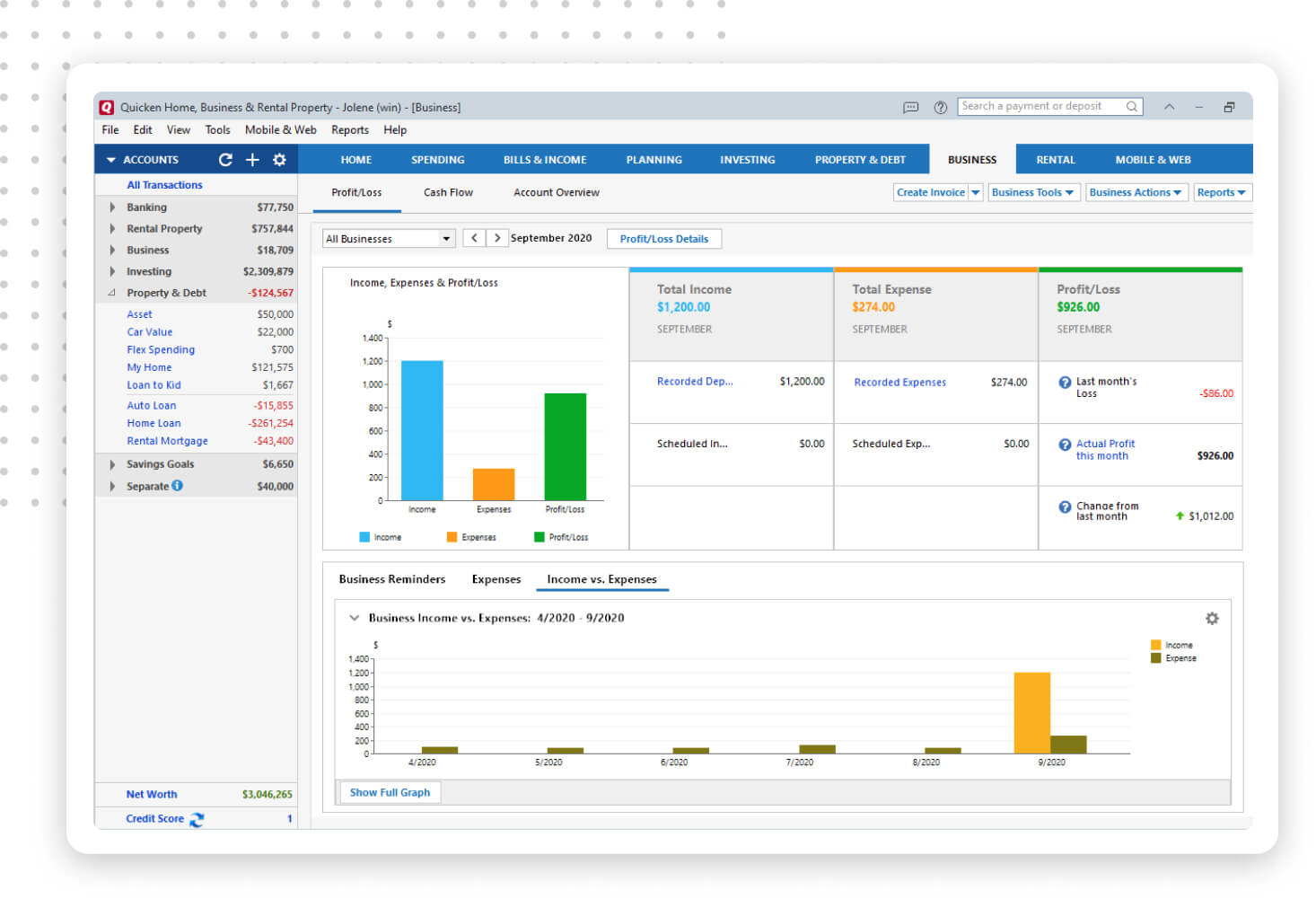

Quicken Home Business Download Quicken

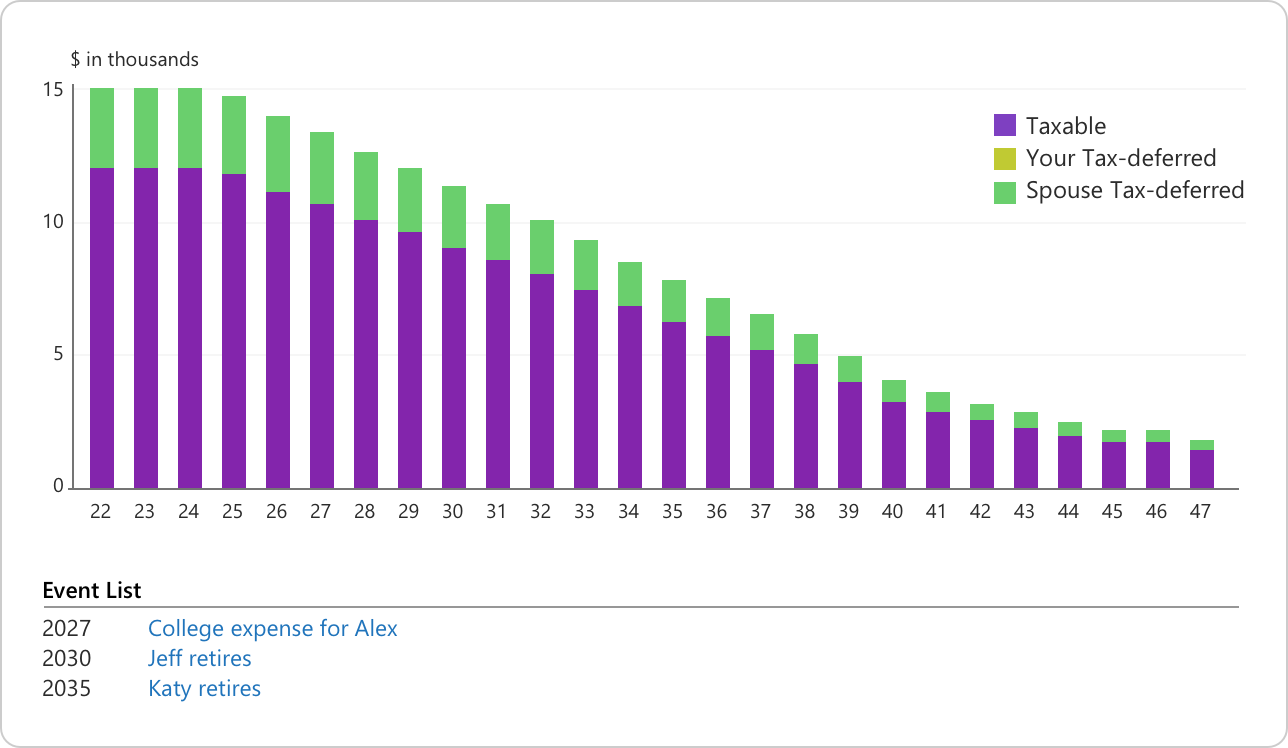

The retirement funds are.

. Web Asset depletion mortgage example Lets say a 49-year-old mortgage borrower has 2000000 in liquid assets and another 500000 in retirement or investment accounts. Its not a bad thing even though deplete sounds bad. Web Lets discuss some of the types of verifications that will need to be made via asset statements during the mortgage application process.

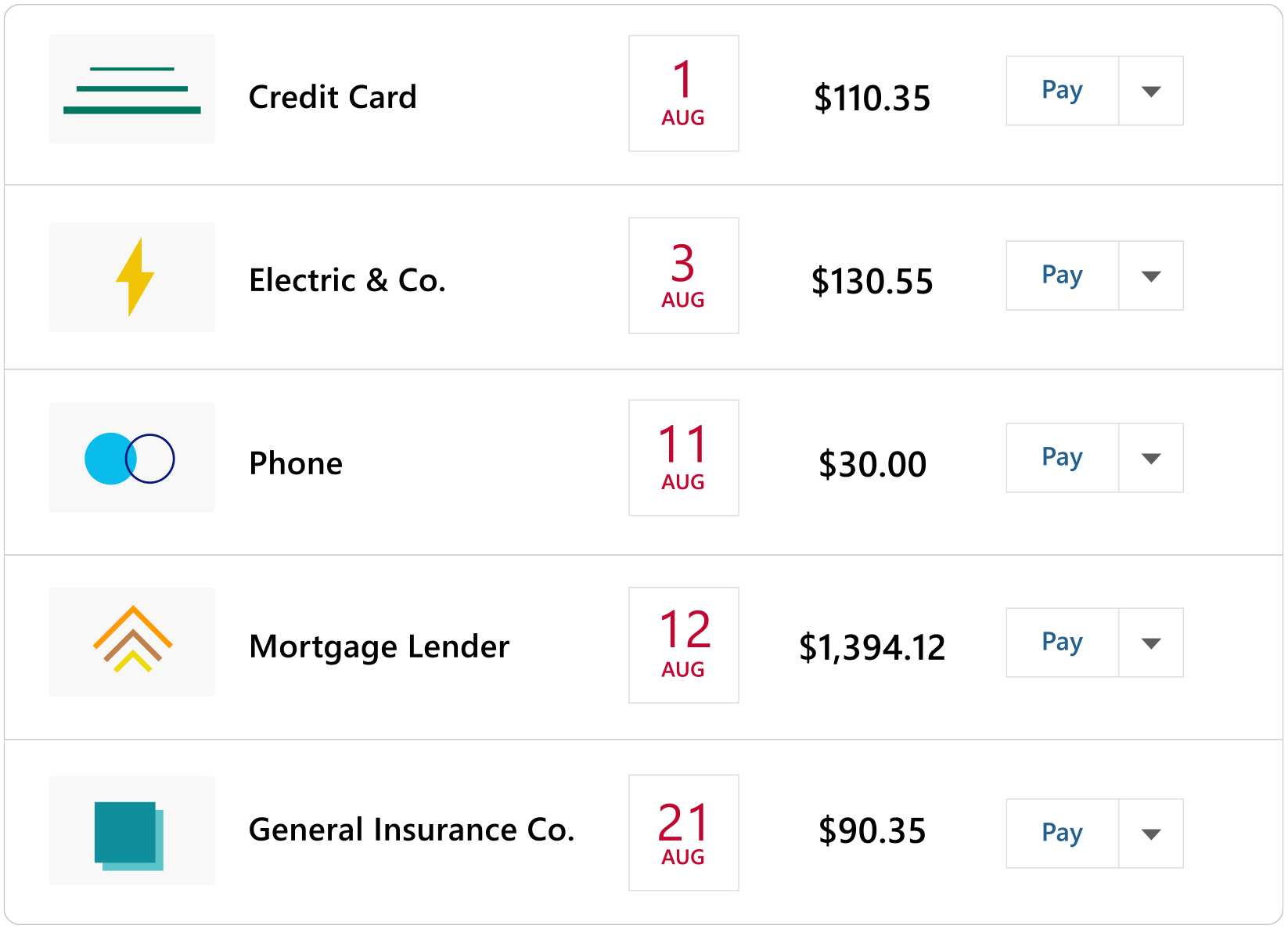

Heres how their monthly. You must already have set up both the house and loan account s in Quicken to link them. Built-in loan calculator.

Web The balance of the loan has nothing to do with the value of the asset. Web An asset depletion loan allows you to use your assets to qualify for a mortgage instead of income and does not require you to be employed. Mortgage lenders will want to verify that you have the means to pay the principal interest taxes and insurance PITI on your mortgage.

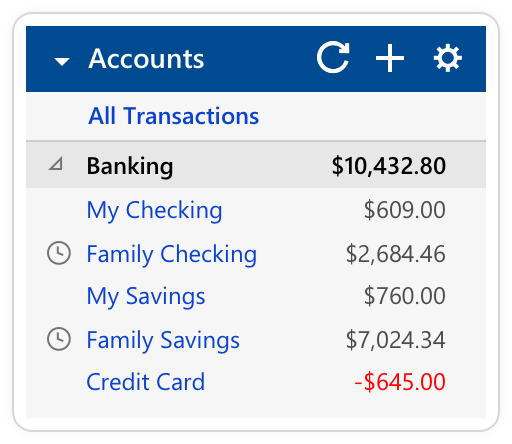

Credit scores as low as 500 accepted. Web For an easy way to track your mortgage balance along with the rest of your finances connect your mortgage account in Quicken. Web Asset Depletion loans are also known as asset based mortgages.

Down payments as low as 10. With an asset-based loan agreement also known as an asset depletion loan borrowers are granted a loan based on their assets. Your remaining balance will update automatically month after month.

Web Many asset-based lenders require loans to be adjustable-rate mortgages. Over time if you want to adjust the value of the asset based on estimates of what you could sell the home or car for you could do that with an adjusting entry -- but this isnt hard financial. What Do Asset Depletion Loans Offer.

Asset depletion lenders offer programs with the following potential advantages. How Asset Depletion Loans Work. Web Now you can qualify for a Mortgage with Assets.

Repeat steps 1 through 4 for any other loan accounts linked to this asset. You can utilize your savings from your checking savings accounts your investments such as stocks bonds and mutual funds and even your retirement accounts to qualify for a loan. Web Griffin Funding takes a common-sense approach to underwriting asset-based loans for a painless application process.

Its using your liquid assets the money youve worked hard to earn by working and investing and enjoying. Is the nations largest online retail mortgage lender and the second-largest retail mortgage lender online or brick-and-mortar in the US. Not with HomePromise we offer fixed rate asset-based mortgages so you have the safety of a level payment for the life of your loan.

When you do this Quicken can calculate your equity for you. Web After you create a house account in Quicken or convert a previously existing asset account to a house account you can link it with existing mortgages or loans attached to the property. An asset-based loan or mortgage allows you to utilize the assets you have already invested in to secure the cash.

The same rates apparently apply as for other mortgages. From the Account List select the house account. Web Two Mortgage Accounts with One Asset Account shelquis Member January 24 edited January 25 Welp Ive messed this up.

Ie asset-based income is simply another source of income used for. HomePromise also provides asset-based loans for primary residences second homes and investment properties. Web Click the Edit button next to the first loan account you want to work with.

Web Schwab Banks Investor Advantage Pricing offers exclusive interest rate discounts for eligible mortgage loan products through Schwab Banks home lending program provided by Rocket Mortgage. Typically these borrowersinvestors seek to finance deals. Only liquid assets may be counted for purposes of qualifying.

The value of a car or home if you choose to enter it in Quicken at all is what the purchase price was. This capability is determined by items you own that have value. Further if you combine a suitable level of liquid assets saved.

Web The loans are processed and serviced through Quicken Loans. I had an existing Asset account with a Linked Loan account. You can find the details you need in your.

Some people even refer to them as no income high asset loans. This type of funding has proven valuable for hard-to-qualify borrowers who invest in commercial real estate. I have obtained mortgages through Schwab Mortages that were almost entirely qualified based on an asset-based imputed income calculation.

So now Ive got 2 loan accounts. Quicken refreshes the window and displays none next to the attribute Linked Asset Account. Then to use Quickens built-in What-If tools just add your loan information.

To calculate the total amount of your assets you can use 100 of what is in liquid such as bank accounts if borrowers are 595 and older. Web Asset-based lending is a type of financing that focuses on the value or earning potential of an asset rather than the borrowers financials in the underwriting process. Web When you live off your assets you deplete your assets.

Eligible clients may receive a 025-100 interest rate discount on purchase as well as refinance mortgages based on their qualifying assets with Schwab. Now that Rocket Mortgage is reported to be downloading again I added a new loan account. In other words you live off your assets using them as your annual income rather than receiving payment from an employer.

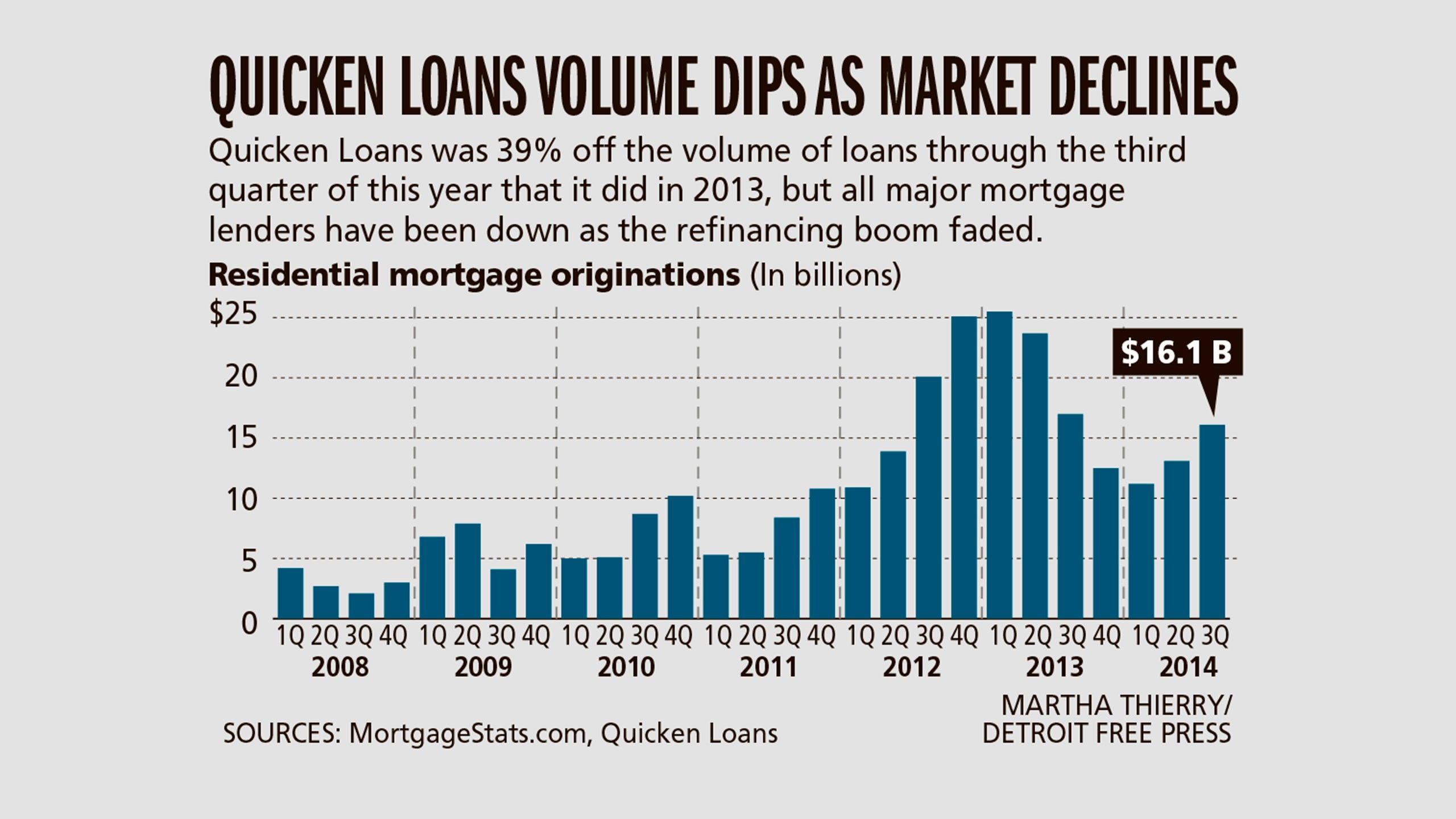

Web Quicken Loans Inc. Rocket Mortgage renamed from Quicken Loans in 2021 changed the industry with fully digital mortgage application tools and on-demand support by phone. Quicken loans also prides itself on being what its website calls the nations leading Veteran Affairs VA lender and the largest FHA lender In other words lack of experience in the mortgage space is.

Quicken Loans Agrees To Pay 32 5 Million To Resolve Fha Loan Allegations With Doj Housingwire

Mortgage Giant Quicken Loans On Pace To Set Home Loan Record

Mortgage Giant Quicken Loans On Pace To Set Home Loan Record

America S Largest Mortgage Lender Quicken Loans

The Kevin And Fred Show Next Level Agents Podcast Addict

Sponsorinsights Archives Sponsorunited

Mortgage Giant Quicken Loans On Pace To Set Home Loan Record

America S Largest Mortgage Lender Quicken Loans

Quicken Premier Software For Windows Download Quicken Today

5 Killer Reasons Handwritten Notes For Mortgage Brokers Just Work Templates Audience Handwritten Mail

Quicken Loans Endures A Rough Year Rises To No 2

Quicken Starter

Quicken Home And Business Software Manage Your Home Small Business Finances

Pdf How To Write A Business Plan Ilham Ilham Nofi Yoga Academia Edu

5 Killer Reasons Handwritten Notes For Mortgage Brokers Just Work Templates Audience Handwritten Mail

Quicken Deluxe Download For Windows Download Quicken

America S Largest Mortgage Lender Quicken Loans